Pecos auto title loans offer secured lending with your vehicle's title as collateral. Before borrowing, understand interest rates, repayment terms, and potential fees to make informed decisions. Gather competitive rate information and existing agreement details for better negotiation. Focus on APR, repayment, collateral, hidden fees, and funding speed during negotiations. Your vehicle's security can impact rates and loan limits, similar to semi truck loans.

Navigating the world of Pecos auto title loans can be a complex process, but understanding your rights and employing strategic negotiation techniques can lead to better terms. This article provides essential insights to empower you in these discussions. By familiarizing yourself with key terms and enhancing your position, you can secure more favorable conditions for your Pecos auto title loan. In summary, knowledge is power when it comes to protecting your financial interests.

- Understanding Pecos Auto Title Loans and Your Rights

- Strategies to Improve Your Negotiation Position

- Key Terms to Focus On During the Discussion

Understanding Pecos Auto Title Loans and Your Rights

Pecos auto title loans are a type of secured lending where your vehicle’s title is used as collateral for the loan. Understanding this type of loan and your rights is crucial before making any decisions. As with any financial transaction, it’s essential to be aware of the terms and conditions associated with Pecos auto title loans. Lenders in San Antonio Loans and Houston Title Loans markets often offer these loans to individuals who may not qualify for traditional bank financing.

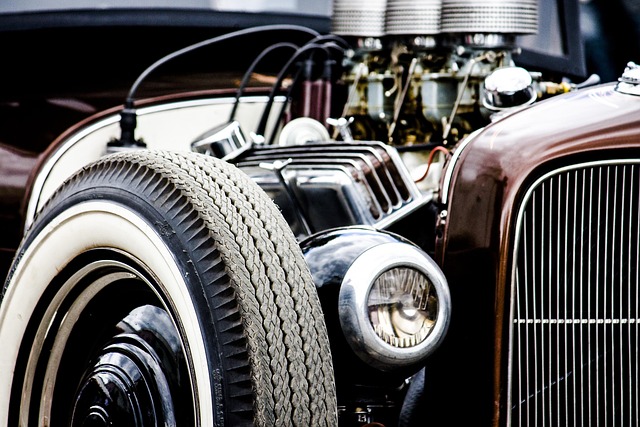

Knowing your loan eligibility and rights ensures you’re making an informed choice. You have the right to understand the interest rates, repayment terms, and any hidden fees associated with the loan. Additionally, be certain about the consequences of defaulting on the loan, as failing to repay can result in the repossession of your vehicle. Educate yourself on these aspects to navigate negotiations effectively and protect your financial well-being.

Strategies to Improve Your Negotiation Position

When negotiating better terms for Pecos auto title loans, it’s essential to prepare and strategize. First, gather all relevant information about similar loans in your area, including rates and conditions offered by competitors. This knowledge positions you as an informed borrower and can give you leverage during negotiations. Additionally, review the fine print of any existing loan agreements to identify potential areas for improvement, such as interest rate caps or early repayment penalties that could be reduced.

Another effective strategy is to consider loan refinancing. Both Dallas Title Loans and Houston Title Loans may offer more flexible terms than your current loan. Research these options and assess if a refinance would result in significant savings over the life of your loan. Presenting concrete figures during negotiations can strengthen your position, demonstrating that you’ve done your homework and are seeking reasonable adjustments to better manage your debt.

Key Terms to Focus On During the Discussion

When negotiating better terms for Pecos auto title loans, there are several key terms to keep your focus on. Firstly, interest rates are a critical area; ensure you understand the annual percentage rate (APR) and ask for explanations if it seems unclear. The last thing you want is hidden fees driving up your overall cost.

Secondly, repayment terms should be discussed openly. Consider how much time you need to pay back the loan – whether it’s a short-term or long-term solution. In light of this, mention same day funding, if speed is a priority, and understand what that means for your repayment schedule. Additionally, inquire about collateral requirements; with Pecos auto title loans, the security on your vehicle could impact both interest rates and loan limits, potentially offering advantages like those found in semi truck loans.

When negotiating Pecos auto title loan terms, educating yourself about your rights and employing strategic communication techniques can empower you to secure more favorable conditions. By focusing on key terms and understanding the value of your vehicle, you can navigate the process with confidence. Remember, knowledgeable negotiation is the key to getting the best deal possible on these loans.