Understanding Pecos auto title loans requirements is key. Lenders assess vehicle value and credit history for terms. A straightforward two-step application process involves gathering documents and submitting an application. Applications reviewed within hours, with quick funding for approved borrowers.

Looking for a quick financial boost? Pecos auto title loans could be an option, offering a streamlined and efficient way to access cash using your vehicle’s equity. This step-by-step guide breaks down the process, from understanding the basic requirements to submitting your application and what happens next. We’ll walk you through each phase, ensuring you’re informed every step of the way regarding Pecos auto title loans.

- Understanding Pecos Auto Title Loans Requirements

- Step-by-Step Application Process Explained

- What To Expect After Submitting Your Application

Understanding Pecos Auto Title Loans Requirements

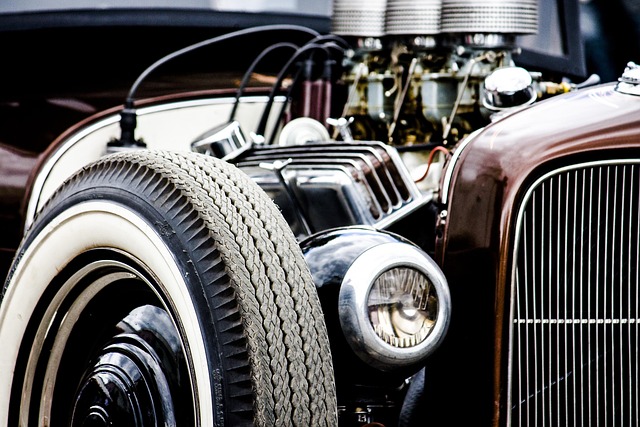

When considering Pecos auto title loans, understanding the requirements is a crucial first step. Lenders will assess your vehicle’s value and your ability to repay the loan. In most cases, Pecos car title loans require that your vehicle is paid off with no outstanding liens, as the lender will need clear ownership of the vehicle to secure the loan. This process aims to protect both parties involved in the Fort Worth loans transaction.

Additionally, lenders will review your income and credit history during the application process for Pecos auto title loans. Loan terms can vary significantly depending on these factors, so it’s essential to provide accurate and complete information. Once approved, you’ll receive funds based on the agreed-upon loan terms, allowing you access to quick cash while using your vehicle as collateral. Keep in mind that Car Title Loans offer a unique opportunity for borrowers who may have limited options for traditional financing.

Step-by-Step Application Process Explained

Applying for Pecos auto title loans is a straightforward process designed to provide quick funding for vehicle ownership. It begins with gathering the necessary documents, which typically include proof of vehicle registration, a valid driver’s license, and insurance information. This initial step ensures that all details are in order and facilitates a smooth loan application.

Next, you’ll submit your application through the lender’s platform, providing personal information such as your name, contact details, and employment status. Once received, the lender will evaluate your application and verify the details provided against official records. This process is crucial for assessing eligibility and determining loan terms, including interest rates and repayment periods. A successful application results in a loan extension, giving you access to the funds you need without delay.

What To Expect After Submitting Your Application

After submitting your Pecos auto title loan application, you can expect a swift response from our team. We understand that accessing emergency funds is crucial for many, so we prioritize processing applications quickly. Within hours of receipt, our specialists will review your details to assess your loan eligibility based on various factors, including the value of your vehicle and your ability to repay.

If approved, you can look forward to receiving your fast cash in a timely manner. We offer a convenient and straightforward process, ensuring that you get the support you need during financial emergencies. Remember, Pecos auto title loans are designed to provide you with access to funds quickly without the usual delays associated with traditional loan applications.

Pecos auto title loans can be a convenient and quick solution for those in need of immediate financial support. By understanding the requirements, following a straightforward application process, and knowing what to expect afterward, you can navigate this option with confidence. Remember that keeping your vehicle’s registration and proof of insurance handy will streamline the process. Once your Pecos auto title loan application is submitted, be prepared for a swift evaluation and potential approval, providing you with the funds you need when it matters most.