Pecos auto title loans provide quick cash access for individuals with limited credit history, using vehicle equity. These loans offer flexible terms and lower interest rates compared to traditional secured lending. Before refinancing, assess your financial situation, compare rates from multiple lenders in Pecos and Fort Worth, explore alternative funding options, and understand the impact of loan-to-value ratio and creditworthiness on interest rates.

Looking to refinance your Pecos auto title loan? This comprehensive guide is your roadmap. We break down the basics and benefits of Pecos auto title loans, helping you understand if refinancing is right for you. Learn key eligibility factors and discover powerful strategies for a successful refinance. Maximize your savings and take control of your finances with these expert tips tailored for Pecos auto title loan holders.

- Understanding Pecos Auto Title Loans: Basics and Benefits

- Evaluating Your Eligibility for Refinancing

- Strategies for Successful Pecos Auto Title Loan Refinance

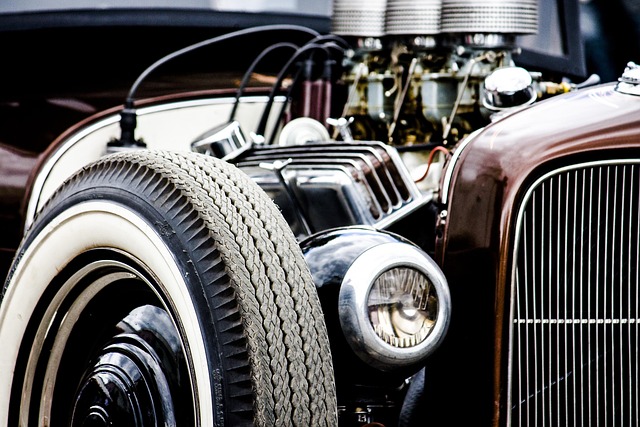

Understanding Pecos Auto Title Loans: Basics and Benefits

Pecos auto title loans offer a unique financing option for individuals needing quick access to capital. This type of loan utilizes the value of your vehicle, specifically its title, as collateral. By leveraging your car’s equity, borrowers can secure a cash advance without strict credit requirements, making it an attractive solution for those with limited or poor credit history. The process involves signing over your vehicle’s title to the lender until the loan is repaid, typically with affordable monthly installments.

One of the key benefits of Pecos auto title loans is their ability to provide emergency funding when traditional banking options are not readily available. Whether it’s unexpected expenses or a need for quick cash, these loans offer a convenient and accessible way to bridge financial gaps. Furthermore, compared to other forms of secured lending, like truck title loans, Pecos auto title loans often have more flexible terms and lower interest rates, making them a viable option for both short-term relief and long-term financial planning.

Evaluating Your Eligibility for Refinancing

Before considering refinancing your Pecos auto title loans, it’s crucial to evaluate your eligibility. Lenders will assess your current financial situation and vehicle value to determine if refinancing is a suitable option for you. One significant factor is your loan-to-value ratio; this compares the outstanding loan balance against the estimated value of your vehicle. If you’ve made substantial progress in paying off your initial loan, you might be eligible for better terms, including lower interest rates, during refinancing.

Additionally, your creditworthiness plays a vital role. Lenders will review your credit history and score to decide on the terms offered. In the case of Houston title loans, improving your credit score can significantly impact the interest rates you’ll receive. A lower rate means saving money over time on your loan payoff. Ensure you understand the current market trends for Pecos auto title loans and shop around for the best deals to make an informed decision.

Strategies for Successful Pecos Auto Title Loan Refinance

When considering Pecos auto title loans refinance, it’s crucial to approach the process strategically. First, assess your current financial situation and determine if refinancing aligns with your goals. Compare interest rates offered by various lenders in Pecos and Fort Worth Loans; look for competitive rates that save you money over time. Understanding the market is key to making an informed decision.

Additionally, evaluate why you initially took out a title loan. Were it for unexpected expenses or emergency funds? Refinancing could provide an opportunity to free up cash flow if your financial situation has improved. Consider alternative sources of funding like personal loans or credit cards for future needs, avoiding the need for a title loan altogether. This shift can help break the cycle of debt and save you from high-interest rates associated with Pecos auto title loans.

Refinancing Pecos auto title loans can be a strategic move to save money and gain financial flexibility. By understanding the basics, evaluating your eligibility, and employing effective strategies, you can successfully navigate the refinancing process. Remember, Pecos auto title loans offer quick access to cash, but refinancing allows you to optimize terms tailored to your current needs. Embrace these steps to make an informed decision that best suits your financial journey.