Pecos auto title loans provide swift and accessible financial support during crises, using vehicle equity for approval and funding within days, ideal for urgent expenses, suitable for various credit histories, and offering a controlled solution for managing financial challenges without extensive documentation.

In times of financial crisis, accessing quick and reliable funding can be a lifeline. Pecos auto title loans offer a unique solution, providing immediate support to those in need. This article explores how these loans can help during challenging economic periods. We delve into the benefits, from their accessibility and fast funding to the secure process designed to protect borrowers. Understanding Pecos auto title loans can empower individuals to navigate financial crises with confidence.

- Unlocking Financial Support: Pecos Auto Title Loans Explained

- Benefits During Crises: Accessibility and Fast Funding

- Securing Loans: The Process and Protection for Borrowers

Unlocking Financial Support: Pecos Auto Title Loans Explained

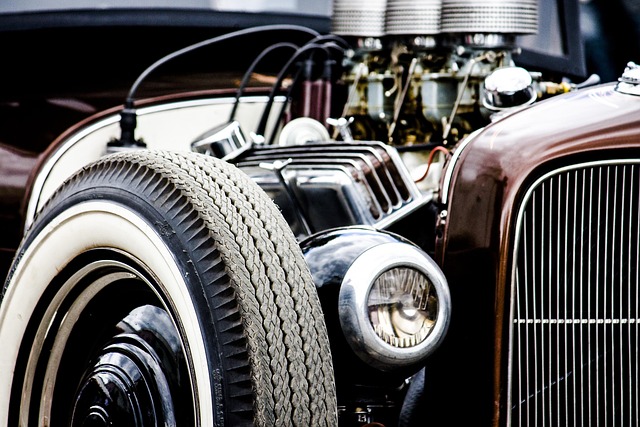

Pecos auto title loans offer a financial lifeline during unexpected crises. This type of loan utilizes an individual’s vehicle—be it a car, motorcycle, truck, or boat—as collateral, allowing them to access funds quickly. The process involves pledging the vehicle’s title, ensuring lenders have security for the loan amount. This alternative financing option is particularly beneficial during financial emergencies when traditional banking routes may be restricted or inaccessible.

Compared to other secured loans, Pecos auto title loans often provide more lenient approval criteria and faster turnaround times. Individuals facing sudden expenses like medical bills, home repairs, or unexpected life events can find relief through this avenue. Moreover, these loans cater to a wide range of borrowers, including those with less-than-perfect credit, offering a practical solution when other financial options are scarce.

Benefits During Crises: Accessibility and Fast Funding

In times of financial crisis, access to quick funding can be a lifeline for many individuals and businesses. Pecos auto title loans offer a unique advantage in such situations due to their accessibility and fast funding capabilities. Unlike traditional bank loans that often involve lengthy application processes and stringent eligibility criteria, these loans provide a more straightforward path to obtaining cash.

One of the key benefits is the convenience of an online application process. Applicants can submit their details from the comfort of their homes, eliminating the need for in-person visits. This is especially valuable during crises when physical distances and health considerations might deter people from leaving their residences. Furthermore, Pecos auto title loans boast a swift funding timeline, ensuring that borrowers receive their funds promptly, which can be crucial in managing unexpected expenses or cash flow gaps during challenging economic periods.

Securing Loans: The Process and Protection for Borrowers

Pecos auto title loans offer a unique solution for individuals facing financial crises, providing access to emergency funds using their vehicle’s equity. The process begins with borrowers submitting an application, which typically requires personal and vehicle information. This initial step is crucial as it sets the stage for the entire loan transaction. Once approved, the lender assesses the car’s value and offers a loan amount based on the title pawn, ensuring borrowers receive fair terms.

Unlike traditional loans that often require extensive documentation and credit checks, Pecos auto title loans cater to those with limited or no credit history. The absence of stringent credit criteria makes these loans accessible to a broader range of individuals. Furthermore, the security provided by the car title offers protection for lenders, allowing for more flexible borrowing options. This alternative financing method empowers borrowers to navigate financial challenges while maintaining some control over their assets.

Pecos auto title loans have emerged as a valuable resource during financial crises, offering quick access to funds with minimal hassle. By leveraging the equity in their vehicles, borrowers can secure loans swiftly, providing much-needed relief during challenging times. The simplicity and accessibility of this alternative financing option ensure that folks in Pecos can navigate through difficult periods with better financial stability.