Pecos auto title loans provide swift financial aid for those with limited banking access, secured by a vehicle's title, offering direct deposit funds and a straightforward process. Ideal for debt consolidation or unexpected costs, these loans have simpler requirements than traditional methods, but borrowers must be aware of potential risks like default penalties (repossession) and high-interest rates. Researching reputable lenders with transparent terms is crucial to mitigate these dangers.

In the financial landscape of Pecos, auto title loans have emerged as both a risk and a rewarding opportunity for borrowers. This comprehensive guide delves into the intricacies of Pecos auto title loans, offering a clear understanding of what they are, their potential pitfalls, and the significant rewards they offer. By exploring these aspects, you’ll gain valuable insights to make informed decisions regarding this unique lending option.

- Understanding Pecos Auto Title Loans: A Comprehensive Overview

- Potential Risks and Pitfalls to Be Aware Of

- Unlocking Benefits: Rewards of Securing a Loan

Understanding Pecos Auto Title Loans: A Comprehensive Overview

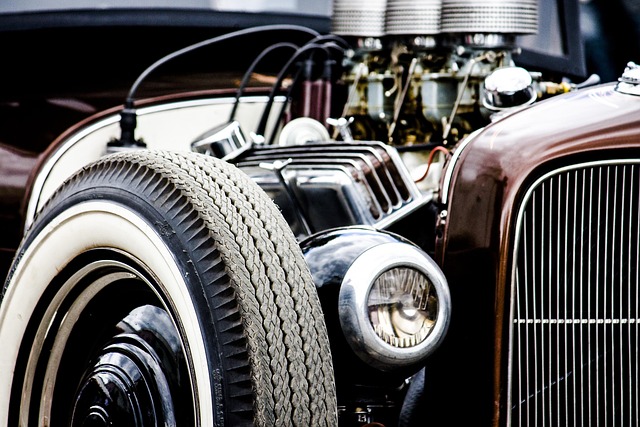

Pecos auto title loans are a type of secured lending where individuals use their vehicle’s title as collateral to secure a loan. This financial instrument offers a unique opportunity for those in need of quick cash, especially when traditional banking options may be limited. The process involves a simple application, where lenders assess the value of the vehicle and determine the loan amount. Once approved, borrowers receive funds via direct deposit, providing immediate access to capital.

These loans are particularly appealing for individuals seeking debt consolidation or emergency financial support. Instead of dealing with complex credit checks and lengthy applications, Pecos auto title loans offer a faster alternative. Borrowers can use the borrowed funds for various purposes, such as paying off high-interest debts, covering unexpected expenses, or investing in business opportunities. However, it’s crucial to understand the terms and conditions, including interest rates, repayment schedules, and potential penalties for late payments, to ensure an informed decision regarding this type of secured lending.

Potential Risks and Pitfalls to Be Aware Of

When considering Pecos auto title loans, it’s crucial to be aware of potential risks and pitfalls. One significant danger is the risk of defaulting on the loan, which can lead to severe financial consequences. If you fail to make payments as agreed, lenders may repossess your vehicle, resulting in a total loss of ownership rights. This is particularly concerning for borrowers who rely heavily on their vehicles for daily transportation and livelihood.

Another risk to keep in mind is the high-interest rates often associated with auto title loans in Pecos. These rates can quickly compound, leading to substantial additional fees and making it challenging to pay off the loan promptly. Moreover, some lenders may employ aggressive collection tactics or charge hidden fees, further complicating the repayment process. It’s essential to thoroughly research and choose reputable lenders who offer transparent terms and conditions, such as those that provide clear information about interest rates, payment schedules, and potential penalties for late payments, ensuring a safer borrowing experience.

Unlocking Benefits: Rewards of Securing a Loan

Pecos auto title loans offer a unique opportunity for individuals seeking quick access to cash, especially those with limited credit options. By using your vehicle’s equity as collateral, you can unlock several benefits and advantages. This type of loan is particularly appealing to those with less-than-perfect credit histories or who need funds urgently but cannot qualify for traditional bank loans or Dallas title loans.

Securing a Pecos auto title loan provides immediate financial relief, enabling you to cover unexpected expenses, consolidate debts, or make that much-needed repair. The process is often simpler and faster than other loan options, as it involves less stringent requirements and a shorter application time frame. Additionally, loan refinancing might be an available option, allowing borrowers to adjust repayment terms if needed, further enhancing the flexibility of this alternative financing method for bad credit loans.

Pecos auto title loans can be a powerful financial tool, offering both risks and rewards. By understanding the potential pitfalls and benefits outlined in this article, you’re better equipped to make an informed decision. While these loans provide quick access to cash, it’s crucial to proceed with caution, especially regarding interest rates and repayment terms. Weighing the risks against the rewards will help you secure a loan that aligns with your financial goals without putting your assets in jeopardy.