Pecos Auto Title Loans provide Texas residents with a quick and flexible financing option, using their vehicle's title as collateral for fast cash advances. These loans cater to individuals with poor credit or emergency financial needs, offering manageable loan terms and higher amounts than personal loans. The approval process considers market value, age, condition, financial history, and income, allowing borrowers to access funds promptly while ensuring a consistent repayment structure, but interest rates and fees should be carefully evaluated.

“Uncover the ins and outs of Pecos auto title loans—a powerful financial tool for those in need. This comprehensive guide breaks down the complexities, focusing on loan amounts and their limits. We explore how these limits are set, offering transparency in a simple manner.

Whether you’re curious about your loan options or eager to understand repayment processes, this article provides valuable insights into Pecos auto title loans, empowering informed decisions.”

- What Are Pecos Auto Title Loans?

- How Are Loan Amount Limits Determined?

- Understanding Your Loan Options and Repayment

What Are Pecos Auto Title Loans?

Pecos Auto Title Loans are a type of secured loan where the borrower uses their vehicle’s title as collateral. This unique financing option allows individuals in Pecos, Texas, to access a certain amount of cash by leveraging their car’s value. It’s an alternative funding solution for those who might not qualify for traditional bank loans or need quick access to funds. With these loans, lenders offer flexible loan terms and the potential for a relatively fast cash advance.

Unlike Houston Title Loans, which can vary widely in terms of availability and regulations, Pecos Auto Title Loans are designed to provide a more straightforward process. Borrowers can use their vehicle’s title as security, ensuring a consistent framework for repayment. This method is especially appealing to folks who require emergency funds or have poor credit history, as it offers a chance to gain access to much-needed cash without stringent requirements.

How Are Loan Amount Limits Determined?

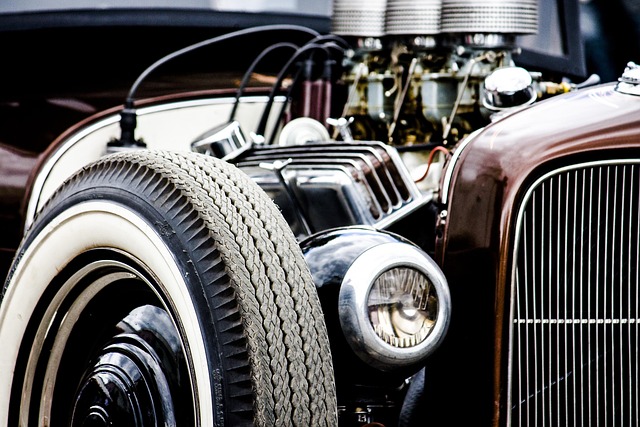

The loan amount limits for Pecos auto title loans are determined by a few key factors. Lenders consider the current market value of your vehicle, its age, and the overall condition it’s in to assess its resale value. This appraisal process is crucial in setting the maximum loan amount because it guarantees that the lender can recover their funds if you’re unable to repay the loan. The older or less valuable a car is, the lower the loan limit will likely be.

Additionally, lenders also factor in your financial history and income when determining these limits. Unlike traditional loans that often require a credit check, Pecos auto title loans are secured loans backed by your vehicle’s title. This means if you can demonstrate a stable source of income to cover the monthly payments, even with less-than-perfect credit, you may still qualify for a higher loan amount.

Understanding Your Loan Options and Repayment

When considering Pecos auto title loans, understanding your loan options and repayment terms is crucial. These loans are designed for individuals who own a vehicle free and clear and need quick funding to cover unexpected expenses or achieve financial goals. The process typically involves using your vehicle’s title as collateral, which can result in higher loan amounts compared to traditional personal loans. Loan requirements vary between lenders, but generally, you’ll need a valid driver’s license, proof of income, and the title to your vehicle.

Repayment for Pecos auto title loans is usually structured as a series of fixed payments over a predetermined period, ranging from several months to a year. Unlike boat title loans or other types of secured loans, these repayment plans focus on manageable installments that align with your budget. Quick funding is one of the significant advantages, allowing you to access the funds you need without extensive waiting periods. However, it’s essential to carefully consider the interest rates and fees associated with these loans to ensure they fit within your financial capabilities.

Pecos auto title loans offer a convenient way to access funds using your vehicle’s equity. Understanding loan amount limits is crucial for making an informed decision. By knowing how these limits are determined and exploring your repayment options, you can choose the best pecos auto title loan that suits your financial needs. Remember, responsible borrowing ensures you get the most from this type of loan without causing undue strain on your budget.